Der aktuelle WG-Mietindex für das Wintersemester 2017 der empirica ag liegt vor.

Auch dieses Semester müssen Studenten wieder tiefer in die Tasche greifen. Wie alle, die derzeit umziehen. Standardpreise für ein unmöbliertes WG-Zimmer

Der aktuelle WG-Mietindex für das Wintersemester 2017 der empirica ag liegt vor.

Auch dieses Semester müssen Studenten wieder tiefer in die Tasche greifen. Wie alle, die derzeit umziehen. Standardpreise für ein unmöbliertes WG-Zimmer

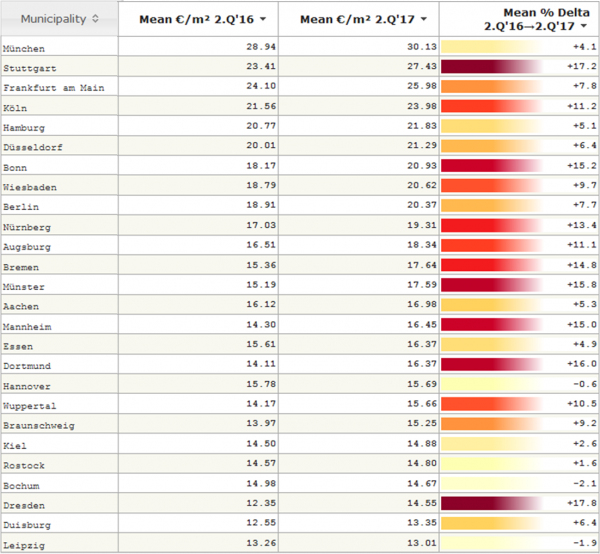

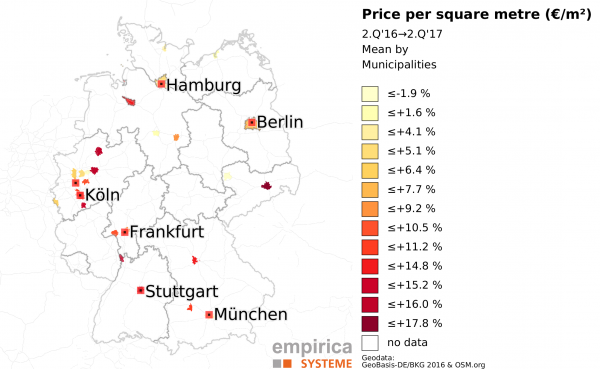

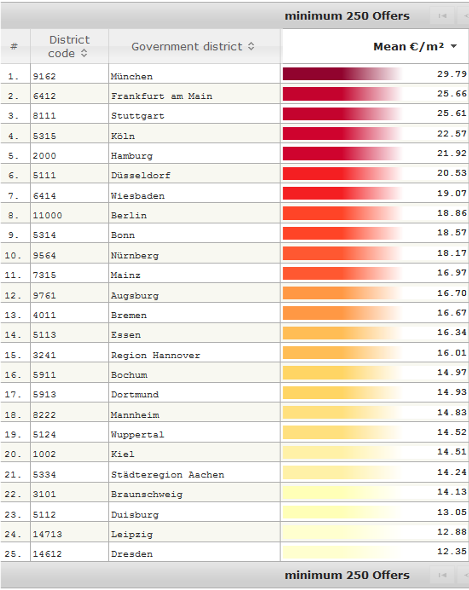

Since our latest rent overview in February 2017, Munich has exceeded the 30 Euro per m² threshold and Stuttgart has pushed Frankfurt from the second to the third place – with a rent of 27.43 € per m². Compared to the second quarter 2016, Stuttgart is also the A-City with the highest rent increase. Since then, only Dresden has seen a (relatively) higher increase. The analysed advertisements are furnished, for temporary use and the rates include ancillary costs.

The total rent in the German A-Cities varies from 1167€ per month in Munich, 992€ in Frankfurt, 968€ in Stuttgart, 902€ in Cologne, 883€ in Dusseldorf, to 820€ in Berlin and 794€ in Hamburg.

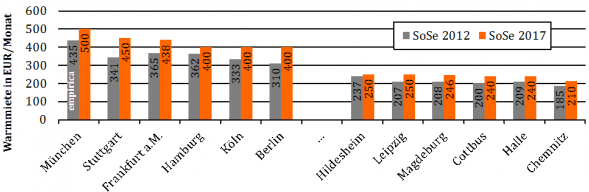

Der aktuelle WG-Mietindex der empirica ag zum Sommersemester 2017 liegt vor, seit 2012 hat sich der Preis für ein Standard-WG-Zimmer um 20% erhöht.

Zu Beginn des Sommersemesters 2017 ist der Standardpreis für ein unmöbliertes WG-Zimmer mit 500 EUR in München am höchsten, gefolgt von Stuttgart (450 EUR) und Frankfurt a.M. (438 EUR). Die günstigsten Angebote gibt es derzeit in Chemnitz (210 EUR) sowie in Cottbus und Halle (240 EUR). IN den Studentenstädten hat sich seit 2012 der Preis für ein Standard-WG-Zimmer um 20% erhöht.

Auch eine aktuelle Studie vom IW Köln zeigt deutliche Mietsteigerungen. Für Berlin gilt für Studenten entsprechend der aktuellen Meldungen, dass Wohnen zwischen 30% (seit 2012) und 42% (2010) teurer geworden ist. Angesichts derzeitiger Preissteigerungen auf den Wohnungsmärkten

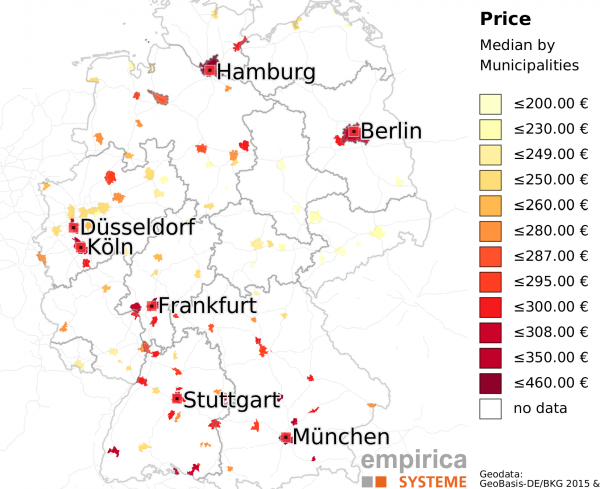

For those who are interested in German market for micro-living and student housing, we have taken a look into our data to figure out some facts which may improve the understanding of the German student housing market.

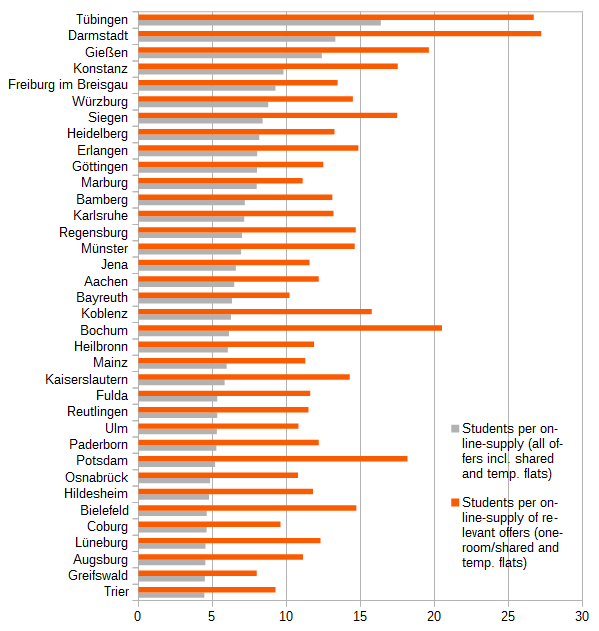

The university cities show the highest student demand excess, measured by students per online ads [(students – students in residence halls)/online offers)] , especially in student compatible sub-markets (‘one-room-flats’, ‘shared flats’ and ‘temporary living offers’). In Tübingen and Darmstadt there are more than 25 students for each student compatible residence offer.

We found out, that the market segment ‘shared flats’ is essential and valuable in context of analysing student housing markets as well as for micro-living issues.

High market shares of ‘shared flat offers’ indicate student markets, as well as markets with high demand for ‘one-room-flats’ and ‘micro-apartments’. Rates for ‘shared flats’ also indicate accepted market rents, their upper percentiles show a critical willingness to pay and their spatial distribution indicates student hotspots. Despite these aspects the segment is hardly under investigation.

The increasing flexibility of the labour market, as well as the internationalization of education and universities, improve the attractiveness of micro living and student housing as an asset class in Germany.

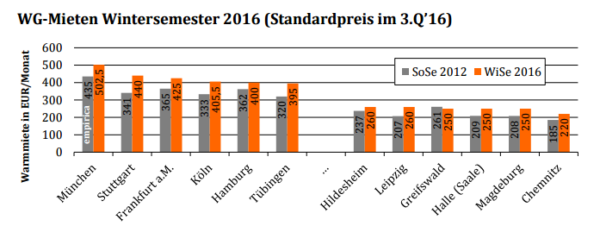

Auf Basis von mehr als 100 Tsd. Mietinseraten für WG-Zimmer erstellt empirica regelmäßig eine Übersicht, die jeweils zum Semesterbeginn Auskunft über die Mietpreise in auf dem studentischen Wohnungsmarkt liefert. Zu Beginn des Wintersemesters 2016 ist der Standardpreis für ein unmöbliertes WG-Zimmer mit 503 EUR in München am höchsten, gefolgt von Stuttgart (440 EUR) und Frankfurt a.M. (425 EUR). Die günstigsten Angebote gibt es in Greifswald, Halle und Magdeburg (je 250 EUR) und in Chemnitz (220 EUR). In den Hochschulstandorten insgesamt liegt der Standardpreis zum aktuellen Semester bei 345 EUR und somit 23% über dem Niveau aus dem Sommersemester 2012.